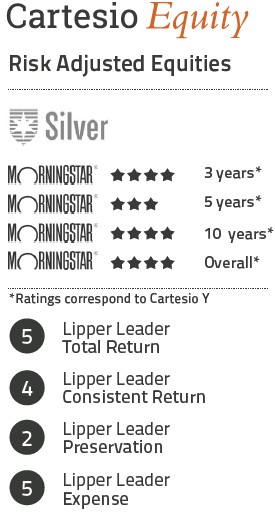

Investment Objetive

Similar to Cartesio Y. Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.

Asset Allocation

Total flexibility in equity exposure (0%-100%). Equity exposure through a limited number of stocks. Maximum of 40% in non European stocks. Maximum 20% net exposure in non Euro currencies.

Institutional Class and Retail (Clase I y Clase R)

Fees

Management: 1.55% of assets

Custody: 0.046%

Codes

ISIN: LU1966822444 (Class I) / LU1966822527 (Class R)

BLOOMBERG: CARTEQI LX (Class I) / CARTEQR LX (Class R)

Custodian

BNP Paribas Securities Services

“Clean” Class (MIFID II – Independent Advice Clients)

Fees

Management: 0.90% of assets and 7.5% of annual performance

Custody: 0,046%

Codes

LU1966822790

BLOOMBERG: CARTEQZ LX

Custodian

BNP Paribas Securities Services

NAV Chart

Returns-Risk

- RETURN (P.A.)

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 5,6%

- 3,2%

- 3,3%

- 4,6%

- European Equities (MSPE)

- 4,4%

- 6,6%

- 6,6%

- 6,4%

- VOLATILITY

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 11,9%

- 14,7%

- 11,8%

- 11,0%

- European Equities (MSPE)

- 14,0%

- 17,9%

- 15,7%

- 18,1%

- SHARPE RATIO

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 0,30%

- 0,15%

- 0,25%

- 0,32%

- European Equities (MSPE)

- 0,17%

- 0,31%

- 0,40%

- 0,29%

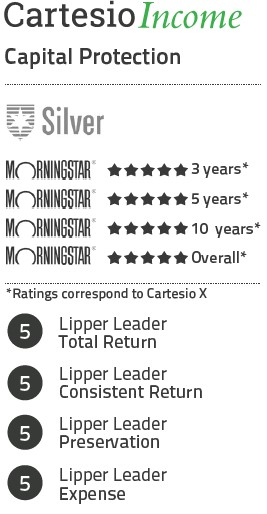

Get to know the other Cartesio Funds

Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.

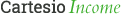

Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than Euro government bonds (Bloomberg/EFFA Euro Gov 7-10 yr Index). Strong emphasis on capital protection.