Cartesio Inversiones SGIIC SA is a mutual fund manager authorised and supervised by the Spanish Comisión Nacional del Mercado de Valores (CNMV). Cartesio is independent and its funds are managed by the same three partners since inception.

The two mutual funds (Cartesio X; Cartesio Y) managed by Cartesio since 2004 are top ranked by MORNINGSTAR which in practical terms means they have delivered attractive returns with low volatility.

Cartesio offers the possibility of investing in two UCITS III Luxembourg SICAVS (Cartesio Income; Cartesio Equity) which replicate the investment strategy of the two funds registered in Spain.

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.

Total flexibility in equity exposure (0%-100%). Equity exposure through a limited number of stocks. Maximum 40% net exposure in non Euro currencies.

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than Euro government bonds (Barclays series Euro Gov 7-10 yr BOND Index). Strong emphasis on capital protection.

Exposure to equities is limited to a máximum of 40% of assets. Exposure to fixed income is variable (0-100%).

To become a client of Cartesio SGIIC please download the file New Clients, fill it and send it via email to clientes@cartesio.com or

fax to +34 91 310 61 30.

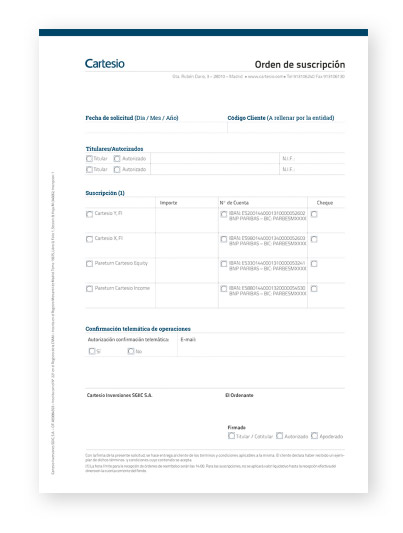

The documents included in the file New Clients are in the following order:

Signature needed of the all the account holders as well as authorized signatories with photocopies of ID documents. This is the only document where the original must be sent to Cartesio.

To be filled and signed by client.

To be signed by client according to fund subscription.

To be filled and signed by client.

See Subscriptions/Redemptions section.

If you need further information please contact us on +34 91 3106240

There are two ways of buying Cartesio Funds:

Bank transfer to the fund's bank account (see below) send it via email clientes@cartesio.com or fax signed subscription form. Order must be confirmed by phone or fax.

Check payable to the fund (by post or by hand in our offices) together with a signed subscription form

IBAN: ES20 0144 0001 31 0000052602 - Beneficiary: Cartesio Y, FI

SWIFT: PARBFRPP - Account 26292D - Beneficiary: PARBESMX - Account: 52602

IBAN: ES98 0144 0001 34 0000052603 - Beneficiary: Cartesio X, FI

SWIFT: PARBFRPP - Account 26292D - Beneficiary: PARBESMX - Account: 52603

IBAN: ES33 0144 0001 31 0000053241 - Beneficiary: Cartesio Equity

SWIFT: PARBFRPP - Account 26292D - Beneficiary: PARBESMX - Account: 53241

IBAN: ES33 0144 0001 31 0000053241 - Beneficiary: Cartesio Income

SWIFT: PARBFRPP - Account 26292D - Beneficiary: PARBESMX - Account: 54530

If you need further information please contact us on +34 91 3106240

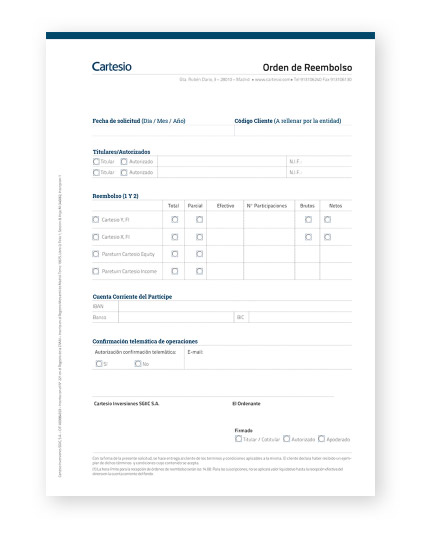

Redemptions will be processed upon reception of Redemption Form (PDF enclosed). The form can be sent by email clientes@cartesio.com, fax or by hand in our office. If faxed a telephone confirmation is needed.

Value date for redemptions is the day the order is received by Cartesio for orders received before 2:00 pm. Capital gains are taxed at 21% for tax residents in Spain.

If you need further information please contact us on +34 91 3106240

To switch funds from other manager into Cartesio Funds, please complete and sign the switching form attached. Please complete carefully all the date concerning the fund you want to switch from and sent the form via email to clientes@cartesio.com o faxed to 91 310 61 30 confirm it by phone.

Switches between funds for Spanish tax residents are exempt from taxes on capital gains.

If you need further information please contact us on +34 91 3106240

If you want more information about our funds or want to buy them, please fill in your details and we will contact you.