Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than Euro government bonds (Barclays series Euro Gov 7-10 yr BOND Index). Strong emphasis on capital protection.

Fees

Management: 0.65% of assets and 7.5% of annual performance.

Custody: 0.055%

Custodian

BNP Paribas Securities Services

Codes

ISIN: ES0116567035

BLOOMBERG: MSCXVDI SM

Asset Allocation

Fixed income exposure (0-100%), no more than 30% invested in high-yield. Exposure to equities is limited to a máximum of 40% of assets. Reference currency: Euro. Currency exposure limited to 20% of assets.

NAV Chart

Returns-Risk

- RETURN (P.A.)

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 5,1%

- 3,7%

- 2,7%

- 4,0%

- European Equities (MSPE)

- -3,7%

- -1,9%

- 0,5%

- 3,2%

- VOLATILITY

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 4,9%

- 5,9%

- 4,6%

- 4,0%

- European Equities (MSPE)

- 8,4%

- 7,1%

- 5,8%

- 5,2%

- SHARPE RATIO

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 0,64%

- 0,46%

- 0,51%

- 0,72%

- European Equities (MSPE)

- -0,67%

- -0,41%

- 0,03%

- 0,39%

Get to know the other Cartesio Funds

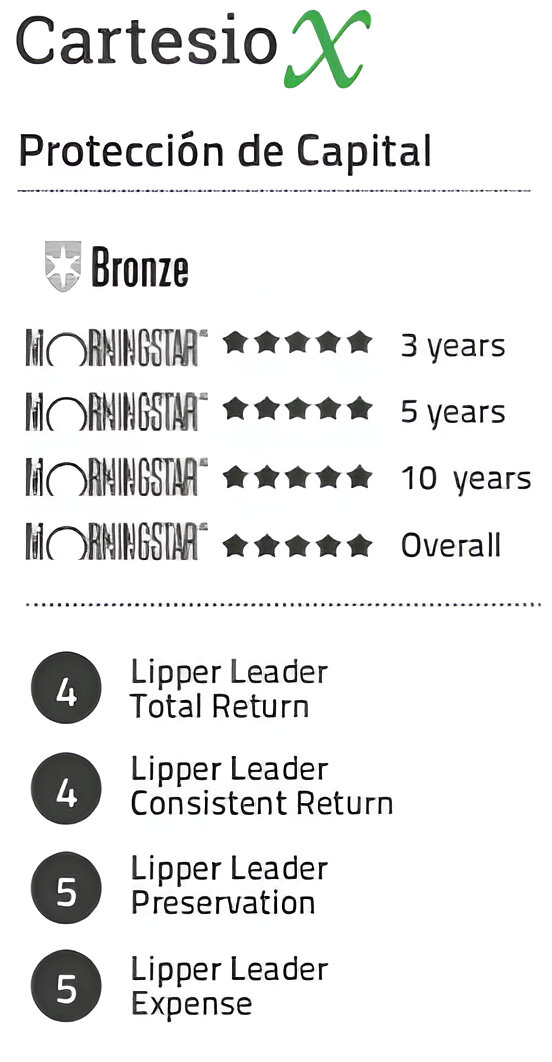

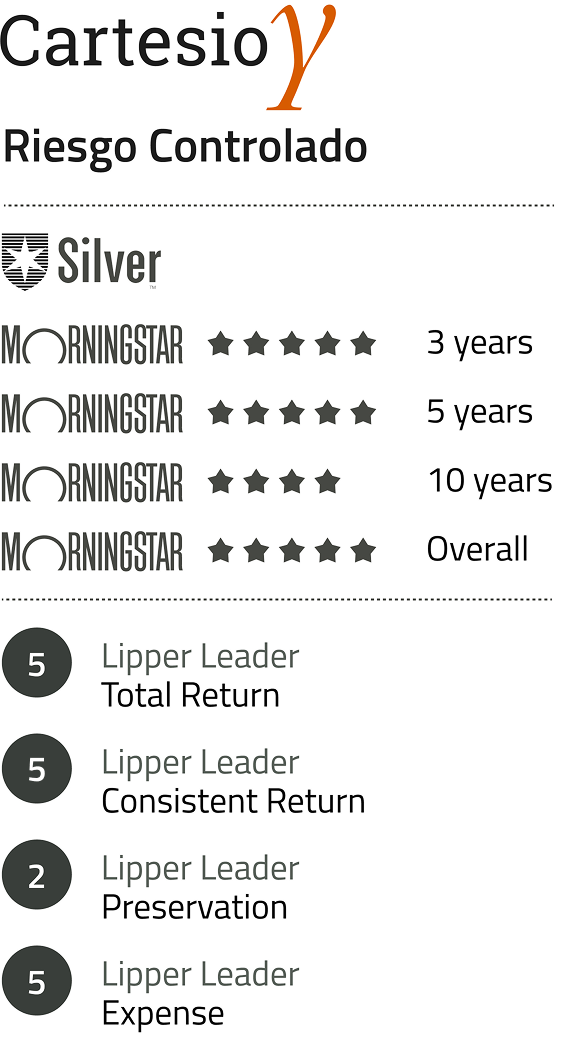

Investment Objetive

Similar to Cartesio X. Long term capital appreciation in real term sin Euros. Seeks higher risk adjusted returns (Sharpe ratio) the Euro government bonds (Bloomberg/EFFA Euro Gov 7-10 yr Index). Strong emphasis on capital protection.

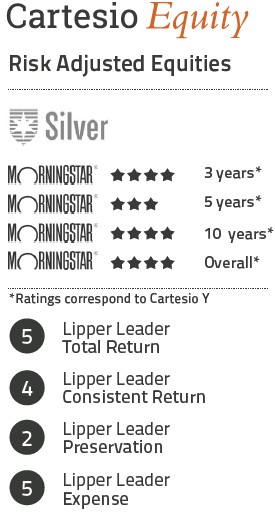

Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.

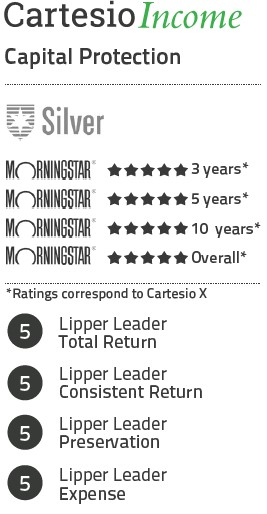

Investment Objetive

Similar to Cartesio Y.Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.