Investment Objetive

Similar to Cartesio X. Long term capital appreciation in real term sin Euros. Seeks higher risk adjusted returns (Sharpe ratio) the Euro government bonds (Barclays series Euro Gov 7-10 yr BOND Index). Strong emphasis on capital protection.

Asset Allocation

Fixed income exposure (0-100%), no more tan 20% invested in high-yield. Exposure to equities is limited to a máximum of 40% of assets. Reference currency: Euro. Currency exposure limited to 20% of assets.

Institutional Class and Retail (Class I y Class R)

Fees

Management: 1.00% of assets

Custody: 0.043%

Codes

ISIN: LU1966822873 (Class I) / LU1966822956 (Class R)

BLOOMBERG: CARTINI LX (Class I) / CARTINR LX (Class R)

Custodian

BNP Paribas Securities Services

“Clean” Class (MIFID II – Independent Advice Clients)

Fees

Management: 0.65% of assets and 7.5% of annual performance

Custody: 0,043%

Codes

ISIN: LU1966823095

BLOOMBERG: CARTINZ LX

Custodian

BNP Paribas Securities Services

NAV Chart

Returns-Risk

- RETURN (P.A.)

- 3 years

- 5 years**

- 10 years**

- Since Inception**

- Cartesio Equity

- 5,0%

- 3,2%

- 2,3%

- 3,8%

- European Equities (MSPE)

- -3,7%

- -1,9%

- 0,5%

- 3,2%

- VOLATILITY

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 5,1%

- 6,2%

- 4,8%

- 4,1%

- European Equities (MSPE)

- 8,4%

- 7,1%

- 5,8%

- 5,2%

- SHARPE RATIO

- 3 years

- 5 years*

- 10 years*

- Since Inception*

- Cartesio Equity

- 0,59%

- 0,36%

- 0,40%

- 0,66%

- European Equities (MSPE)

- -0,67%

- -0,41%

- 0,03%

- 0,39%

Get to know the other Cartesio Funds

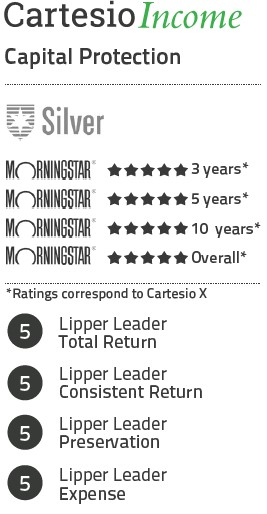

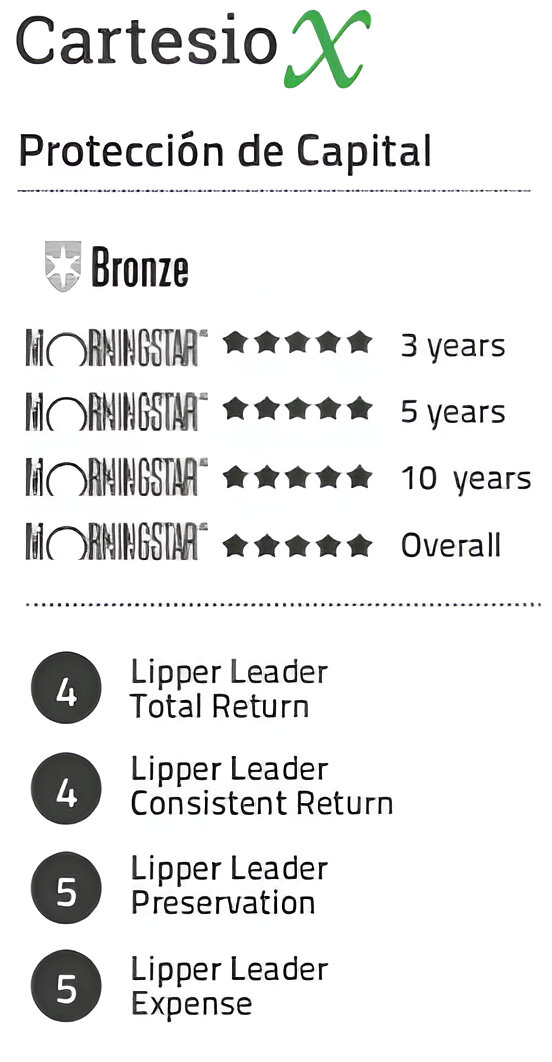

Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than Euro government bonds (Bloomberg/EFFA Euro Gov 7-10 yr Index). Strong emphasis on capital protection.

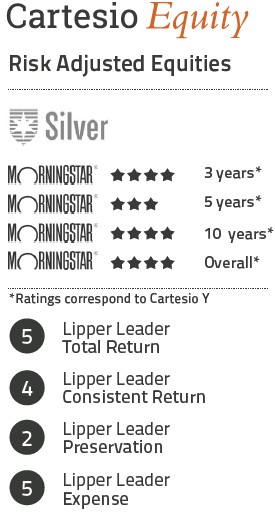

Investment Objetive

Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.

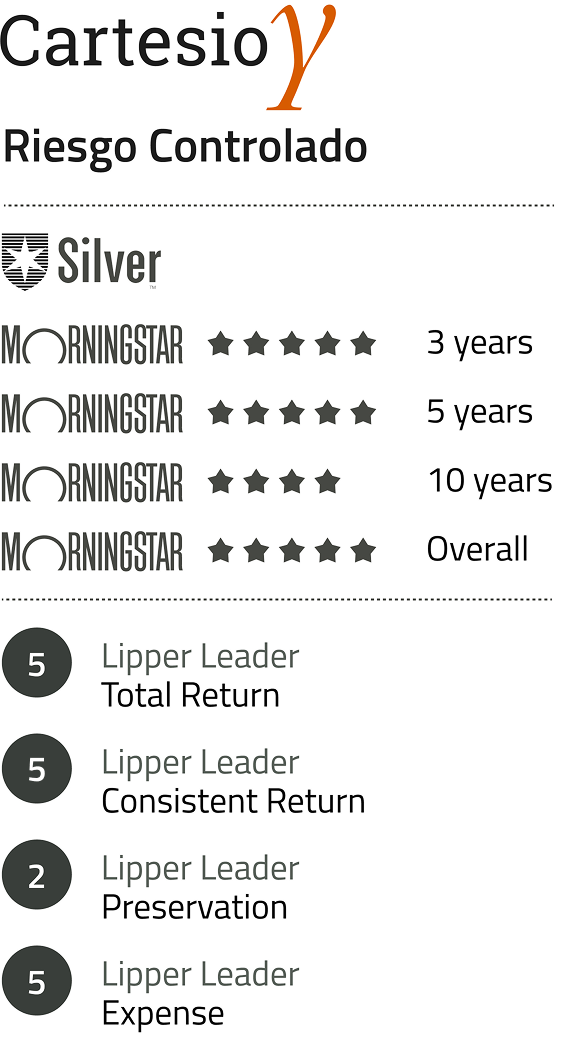

Investment Objetive

Similar to Cartesio Y.Long term capital appreciation in real terms in Euros. Seeks higher risk adjusted returns (Sharpe ratio) than European Equities represented by the MSCI Europe Net Total Return. Willingness to forego potential returns in order to give an adequate capital protection.